Table of Contents

What Are Delinquent Accounts in Accounts Receivable? 4

The Cost of Ignoring Delinquency. 4

Why Managing Delinquent Accounts Matters. 5

Protecting Cash Flow Stability. 5

Avoiding High Collection Costs. 5

Preserving Customer Relationships. 5

Best Practices for Managing Delinquent Accounts. 5

Set Clear Terms and Policies Upfront. 5

Automate Invoicing and Reminders. 5

Escalate Collections Step by Step. 5

Practical Strategies for Managing Late Payments in AR. 6

Offer Flexible Payment Options. 6

Use Incentives and Penalties. 6

Collaborate Across Departments. 6

Building a Strong Accounts Receivable Management System.. 6

Credit Policies and Risk Assessment. 6

Use Analytics and KPIs to Improve. 6

Delinquent accounts in accounts receivable are a frequent headache. When customers don’t pay on time, businesses struggle to cover operational expenses and lose momentum, often juggling late invoices while trying to grow.

This isn’t just about chasing paper. Delayed payments strain cash flow, worsen Days Sales Outstanding (DSO), and can escalate into bad debt write-offs. A recent study revealed that upper-mid-sized businesses face more than $4 million in outstanding invoices every month. If only 1.5% of these turn into bad debt, it results in an annual loss of $720,000. Additionally, manual accounts receivable processes consume significant team hours, with up to 40% of workdays potentially wasted on repetitive tasks such as data entry and follow-up communications. That’s precious time and money lost.

Fortunately, a smart, proactive system built on clear terms, automation, ageing segmentation, and analytics can turn the tide. With the right AR management, you can reduce delinquent accounts, protect cash flow, and rebuild trust with customers.

What Are Delinquent Accounts in Accounts Receivable?

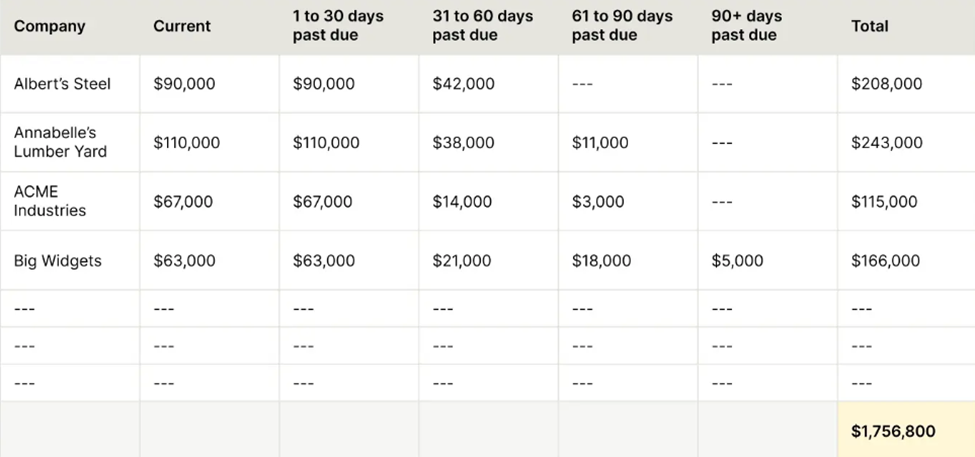

Every business defines delinquency differently: some flag any payment one day late, while others wait several weeks. Most commonly, overdue invoices are grouped into ageing buckets: 30, 60, 90, and 120+ days past due. Having consistent internal definitions helps prioritize which accounts need urgent attention.

Source Image from Versapay

Why Customers Fall Behind

Late payments stem from various causes, such as cash flow constraints, invoice disputes, or simply missed reminders. Understanding patterns of customer payment behaviour lets teams anticipate which accounts are likely to fall behind and intervene earlier.

The Cost of Ignoring Delinquency

- Letting old invoices pile up can snowball:

- Reduced liquidity deprives you of funds when you need them most.

- Rising DSO delays your cash conversion cycle.

- Risk of bad debt climbs.

- Operational stress and reactive, expensive collection efforts ensue.

Why Managing Delinquent Accounts Matters

Protecting Cash Flow Stability

Strong AR processes ensure you have the cash to pay staff, vendors, and seize growth opportunities. Without it, businesses risk turning to expensive short-term financing or stalling critical investments.

Avoiding High Collection Costs

The longer an invoice remains overdue, the harder and more costly it is to recover. Early, structured follow-ups drastically reduce the risk of write-offs and collection expenses.

Preserving Customer Relationships

Most late payers aren’t bad clients; they’re just busy or uninformed. Friendly, consistent communication can help maintain goodwill and prevent churn. A balanced approach keeps the relationship intact while securing payment.

Best Practices for Managing Delinquent Accounts

Set Clear Terms and Policies Upfront

Define and communicate payment terms, due dates, late fee policies, and expectations. Make sure clients understand that timely payment is a shared priority.

Automate Invoicing and Reminders

Using accounts receivable automation can eliminate manual errors and speed up communications. Automated reminders help reduce delays in follow-ups and increase on-time payments. This allows your team to focus on more important tasks.

Escalate Collections Step by Step

- Follow a consistent escalation path to avoid sudden confrontations:

- Friendly reminder just before or right after the due date.

- Firm follow-up if still unpaid.

- Formal notice or handoff to a collection specialist if necessary.

Practical Strategies for Managing Late Payments in AR

Offer Flexible Payment Options

Give customers more than one way to pay: credit/debit cards, ACH, installments, or self-service portals. Such flexibility removes friction and makes paying easier. This is a key shift highlighted by modern AR tools.

Use Incentives and Penalties

Consider offering early-payment discounts to accelerate cash flow. On the flip side, clearly defined late fees can deter procrastination.

Collaborate Across Departments

When sales, customer service, and AR work closely, disputes get resolved faster and miscommunications drop. This collaboration is a cornerstone for effective credit management and smoother collections.

Building a Strong Accounts Receivable Management System

Credit Policies and Risk Assessment

Before extending credit, assess customer risk. Tailor payment terms to match risk level and adjust them as relationships evolve.

Train and Empower AR Teams

Collections teams require skills beyond mere number-crunching; they should be adept at negotiation, empathy, and dispute resolution. Empowered teams deliver better results and stronger customer interactions.

Use Analytics and KPIs to Improve

Track metrics like DSO (Days Sales Outstanding), Average Days Delinquent (ADD), Collection Effectiveness Index (CEI), and AR turnover ratio. This helps improve performance.

ADD shows how overdue your payments are on average, ignoring on-time payments.

CEI surfaces the percentage of receivables collected within a period, with 80%+ considered healthy.

Most teams rely on DSO, but it’s limited because it doesn’t consider due dates.

Analyzing these KPIs helps you spot weaknesses in your process and iterate for better results.

Conclusion

Delinquent accounts in accounts receivable are not just numbers on a report. They represent lost cash, strained relationships, and missed chances. As the stats show, even a 1.5% delinquency rate can cost mid-sized companies over $700,000 annually in bad debt. Without a proactive strategy, those losses only grow.

That’s why forward-thinking companies are re-evaluating how they manage AR. Automation, better communication, and tighter credit policies are the foundation, but execution is where many stumble. You can have the best intentions, yet still lose weeks of productivity chasing overdue invoices.

This is where NCRI makes the difference. NCRI uses data-driven AR insights, industry-specific strategies, and human-centred communication. This helps recover payments faster while keeping customer relationships strong. Our team does more than send reminders. We help your business predict payment behaviour and segment risk. We also create custom escalation paths that match your goals.

With NCRI, you don’t just manage delinquent accounts; you turn them into a predictable cash flow engine. That means lower DSO, reduced bad debt, and more time for your team to focus on growth.

If late payments are holding back your business, it’s time to take control. Partner with NCRI to transform your accounts receivable process into a competitive advantage.

FAQ’s

Q 1: How do delinquent accounts in accounts receivable impact DSO (Days Sales Outstanding)?

Delinquent accounts directly increase your DSO, since unpaid invoices stay longer on the books. A higher DSO signals slower cash conversion and greater risk of bad debt. By addressing delinquent accounts early with structured follow-ups and automation, businesses can lower DSO and keep cash flow stable.

Q 2: What’s the difference between managing delinquent accounts internally vs. outsourcing to experts like NCRI?

Managing internally often relies on manual follow-ups and limited resources, which can slow collections. Outsourcing to NCRI means leveraging specialized AR expertise, predictive analytics, and proven recovery workflows—reducing delinquency rates faster while protecting customer relationships.

Q 3: Can automation alone solve the problem of delinquent accounts?

Automation helps by sending reminders, tracking ageing, and flagging high-risk invoices. But technology alone isn’t enough. Businesses need strong credit policies, proactive communication, and in some cases, expert partners like NCRI to implement tailored escalation strategies.

Q 4: How can NCRI help reduce bad debt from delinquent accounts?

NCRI combines data-driven insights, segmentation, and customer-friendly communication to recover payments before they turn into bad debt. By aligning with your business goals, NCRI helps lower write-offs, shorten collection cycles, and free up your AR team to focus on growth.

0 comments on “Delinquent Accounts in Accounts Receivable: Best Management Practices”